Award-winning Investigative Journalist Robert Parry (1949-2018)

Award-winning investigative journalist and founder/editor of ConsortiumNews.com, Robert Parry has passed away. His ground-breaking work uncovering Reagan-era dirty wars in Central America and many other illegal and immoral policies conducted by successive administrations and U.S. intelligence agencies, stands as an inspiration to all in journalists working in the public interest.

Robert had been a regular guest on our Between The Lines and Counterpoint radio shows -- and many other progressive outlets across the U.S. over four decades.

His penetrating analysis of U.S. foreign policy and international conflicts will be sorely missed, and not easily replaced. His son Nat Parry writes a tribute to his father: Robert Parry’s Legacy and the Future of Consortiumnews.

Thank you for donating

If you've made a donation and wish to receive thank you gifts for your donation, be sure to send us your mailing address via our Contact form.

See our thank you gifts for your donation.

The Resistance Starts Now!

Between The Lines' coverage and resource compilation of the Resistance Movement

- "The man who predicted Trump presidential win now says Trump impeachment could happen," AM Joy with Joy Reid, MSNBC, Jan. 21, 2018

- "Sketchy Kazakh money finds its way into Trump dealings," The Rachel Maddow Show, MSNBC, Jan. 15, 2018

- "Red flags seen in many Trump real estate deals," The Rachel Maddow Show, MSNBC, Jan. 15, 2018

- "Secret Money: How Trump Made Millions Selling Condos To Unknown Buyers," BuzzFeed, Jan. 12, 2018

- "The Scandals of Donald Trump: Presidential Edition," The Atlantic, May 15, 2017

- "Here's what we know so far about Team Trump's ties to Russian interests," Washington Post's ongoing compilation

- "What Comey Was Investigating, Explained," The Moscow Project, Center for American Progress

- "Donald Trump's Financial Ties to Russian Oligarchs and Mobsters Detailed In Explosive New Documentary from the Netherlands," Dutch TV documentary, Alternet.org, May 12, 2017

- Ongoing compilation of Trump's creeping authoritarianism," MotherJones.com

- Full resource list ...

SPECIAL REPORT: "The Resistance - Women's March 2018 - Hartford, Connecticut" Jan. 20, 2018

Selected speeches from the Women's March in Hartford, Connecticut 2018, recorded and produced by Scott Harris

SPECIAL REPORT: "No Fracking Waste in CT!" Jan. 14, 2018

- Jen Siskind Jennifer Siskind, local coordinator for Food and Water Watch, describes the campaign to stop fracking waste in Connecticut, which so far has led to fracking waste bans in 34 towns around the state.

Interviewed by Richard Hill on Mic Check, WPKN Radio, Bridgeport, CT

SPECIAL REPORT: "Resistance Round Table: The Unraveling Continues..." Jan. 13, 2018

- Lindsay Kanaly

The panel discusses Trump's long history of racism and the Republican voter suppression juggernaut confronting Democrats leading up to the 2018 elections. Special guest: Lindsay Kanaly, a lead organizer of the Women's Marches planned for Jan. 20, 2018. Panel: Scott Harris, Ruthanne Baumgartner and Richard Hill on Resistance Roundtable, WPKN Radio, Bridgeport, CT.

SPECIAL REPORT: "Capitalism to the ash heap?" Richard Wolff, Jan. 2, 2018

- Richard Wolff,

Economics professor Richard Wolff declares U.S. capitalism to be beyond repair and

suggests the need for a radical alternative. Interviewed by Richard Hill

SPECIAL REPORT: Maryn McKenna, author of "Big Chicken", Dec. 7, 2017

- Maryn McKenna, investigative journalist and author of Big Chicken, talks about the widespread use and dangers of antibiotics in commercial poultry, beef and fruit production. Interview by Bill Duesing, Richard Hill and Guy Beardsly on WPKN's Organic Farm Stand.

SPECIAL REPORT: Nina Turner's address, Working Families Party Awards Banquet, Dec. 14, 2017

- Nina Turner, president of Our Revolution, talks about the fight ahead for progressives as she receives the Working Families Organization Award for Exceptional Leadership Towards Advancing Progress. The event was held in Meriden, CT.

Produced by Richard Hill.

SPECIAL REPORT: Mic Check, Dec. 12, 2017

- Working Families Party of CT talks strategy and issues for 2018.

Lindsay Farrell, executive director of the Working Families Party of Connecticut, discusses the state's electoral landscape and lays out the issues and strategies that could lead to progressive victories in 2018. Interviewed by Richard Hill.

SPECIAL REPORT: Resistance Roundtable, Dec. 9, 2017

- Disturbing developments in the Trump/Republican Agenda

Focus on the tax bill, destruction of our public lands, North Korea and Trump's private CIA. Panel: Scott Harris, Ruthanne Baumgartner and Richard Hill. Special guest: Jo Macallero of Rise and Resist.

SPECIAL REPORT: On Tyranny - one year later, Nov. 28, 2017

- Professor Timothy Snyder, author of the highly acclaimed resistance manual On Tyranny, discusses his book and offers a fresh assessment of the state of our beleaguered republic. Timothy Snyder, history professor at Yale, is introduced by Stanley Heller, administrator of Promoting Enduring Peace, a Connecticut-based organization that sponsored this event at the United Church Parish House in New Haven on Nov. 28. A brief interview with Snyder conducted by WPKN radio producer, Richard Hill, follows his talk.

SPECIAL REPORT: Mic Check, Nov. 12, 2017

- Lynne Ide, director of program and policy with the Universal Health Care Foundation of Connecticut, talks about the current state of health care coverage in Connecticut. Interviewed by Richard Hill, WPKN radio producer

SPECIAL REPORT: Resistance Roundtable, Nov. 11, 2017

- Focus on the Republican tax plan, the just-released autopsy on the Democratic Party, and Internet censorship by Google, Facebook and Youtube. Including an interview with Hilary Grant, a lead organizer with Action Together Connecticut, who discusses the local results of the recent election, with hosts Richard Hill, Scott Harris and Ruth Baumgartner WPKN producers

SPECIAL REPORT: Rainy Day Radio, Nov. 7, 2017

- Two leaders from Redneck Revolt, an anti-racist, anti-capitalist movement, talk about their work organizing with white working class people in Suffolk County, New York. Interviewed by Richard Hill, WPKN radio producer

SPECIAL REPORT: Rainy Day Radio, Nov. 7, 2017

- Bruce Gagnon, coordinator for the Global Network Against Weapons and Nuclear Power in Space, describes the extent of -- and motives underlying -- the vast US network of military bases around the globe. Interviewed by Richard Hill, WPKN radio producer

SPECIAL REPORT: Resisting U.S. JeJu Island military base in South Korea, Oct. 24, 2017

- Joyakol, South Korean peace activist and singer, discusses the crisis on the Korean peninsula and focuses on the resistance to the U.S. huge military base being constructed on Jeju Island. The event was sponsored by the Greater New Haven Peace Council and this audio was recorded by Richard Hill, WPKN producer.

- Joyakol discusses Americans' biggest misconceptions about the conflict between North and South Korea and the U.S., Interview by Richard Hill, WPKN producer.

SPECIAL REPORT: John Allen, Out in New Haven

- John Allen, founding director of the New Haven Pride Center, Connecticut, talks about his new LGBTQ television show, Out in New Haven, which presents a range of political and cultural issues to the community. Interviewed by Richard Hill on WPKN's Rainy Day Tuesday, Jan. 2, 2018.

2017 Gandhi Peace Awards

Promoting Enduring Peace presented its Gandhi Peace Award jointly to renowned consumer advocate Ralph Nader and BDS founder Omar Barghouti on April 23, 2017.

Subscribe to our Weekly Summary & receive our FREE Resist Trump window cling

Email us with your mailing address at contact@btlonline.org to receive our "Resist Trump/Resist Hate" car window cling!

THANK YOU TO EVERYONE...

who helped make our 25th anniversary with Jeremy Scahill a success!

For those who missed the event, or were there and really wanted to fully absorb its import, here it is in video

Jeremy Scahill keynote speech, part 1 from PROUDEYEMEDIA on Vimeo.

Jeremy Scahill keynote speech, part 2 from PROUDEYEMEDIA on Vimeo.

Between The Lines on Stitcher

Between The Lines Presentation at the Left Forum 2016

"How Do We Build A Mass Movement to Reverse Runaway Inequality?" with Les Leopold, author of "Runaway Inequality: An Activist's Guide to Economic Justice,"May 22, 2016, John Jay College of Criminal Justice, The City University of New York, 860 11th Ave. (Between 58th and 59th), New York City. Between The Lines' Scott Harris and Richard Hill moderated this workshop. Listen to the audio/slideshows and more from this workshop.

Listen to audio of the plenary sessions from the weekend.

JEREMY SCAHILL: Oscar-nominated documentary filmmaker "Dirty Wars"

Listen to the full interview (30:33) with Jeremy Scahill, an award-winning investigative journalist with the Nation Magazine, correspondent for Democracy Now! and author of the bestselling book, "Blackwater: The Rise of the World's Most Powerful Mercenary Army," about America's outsourcing of its military. In an exclusive interview with Counterpoint's Scott Harris on Sept. 16, 2013, Scahill talks about his latest book, "Dirty Wars, The World is a Battlefield," also made into a documentary film under the same title, and was nominated Dec. 5, 2013 for an Academy Award in the Best Documentary Feature category.

Listen to Scott Harris Live on WPKN Radio

Between The Lines' Executive Producer Scott Harris hosts a live,

weekly talk show,

Counterpoint, from which some of Between The Lines'

interviews are excerpted. Listen every Monday evening from 8 to 10 p.m.

EDT at www.WPKN.org

(Follows the 5-7 minute White Rose Calendar.)

Counterpoint in its entirety is archived after midnight ET

Monday nights,

and is available for at least a year following broadcast in

WPKN Radio's Archives.

You can also listen to

full unedited interview segments from Counterpoint, which

are generally available some time the day following broadcast.

Subscribe to Counterpoint bulletins via our subscriptions page.

BTL Blog

BTL Blog

[an error occurred while processing this directive]

Special Programming

Special Programming

[an error occurred while processing this directive]

Progressive Resources

Progressive Resources

A compilation of activist and news sites with a progressive point of view

Subscribe to BTL

Subscribe to BTL

Podcasts: direct or via iTunes

Subscribe to Program Summaries, Interview Transcripts or Counterpoint via email or RSS feed

If you have other questions regarding subscriptions, feeds or podcasts/mp3s go to our Audio Help page.

Stay connected to BTL

![]() Learn how to support our efforts!

Learn how to support our efforts!

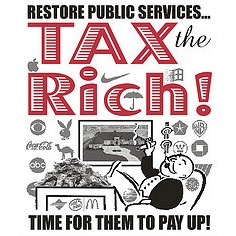

Tax Fairness Debate Takes Center Stage in Presidential Election Year

Posted April 18, 2012

Interview with Lee Farris, senior organizer on Estate and Federal Tax Policy with United for a Fair Economy, conducted by Scott Harris

On April 16, the day before tax returns were due for most Americans, the U.S. Senate took up debate on the so-called “Buffett Rule,” legislation named for billionaire Warren Buffett who declared that wealthy people like him should be paying a greater percentage of taxes on their income - than for example, his secretary. A bill championed by President Obama would have set a minimum 30-percent tax rate for anyone earning at least $1 million a year. But Senate Republicans succeeded in blocking debate on the bill, by a 51 to 45 vote, denying Democrats the 60 votes needed to break a GOP filibuster.

Congressional Republicans and the party’s presidential candidates have long argued that increasing taxes on the nation’s wealthiest individuals and corporations would hinder the creation of new jobs. The position, often referred to as the “trickle-down” philosophy, was adopted by President Ronald Reagan when he was elected in 1980. Over the past three decades, taxes on the wealthiest Americans have decreased to their lowest level since the Great Depression, at the same time income inequality has risen to the highest point since 1928.

After the emergence of the Occupy Wall Street protest movement last September, the issue of growing income inequality has become a focus of discussion across the U.S. – both at the dinner table and in political debate in this presidential election year. A recent CNN poll found that 72 percent of Americans surveyed support the Buffett Rule, including 53 percent of Republicans. Between The Lines’ Scott Harris spoke with Lee Farris, senior organizer on Estate and Federal Tax Policy with United for a Fair Economy, a group that has long drawn attention to America’s rising disparity in wealth. Ferris discusses the Buffett Rule and the other reforms her group advocates to make the nation’s tax system fairer for working families.

LEE FARRIS: It's a 30-year trend of downward or lessening tax rates for wealthy people. That's why you get situations like what Warren Buffett was complaining where he was saying his tax rate is lower that his secretary's tax rate. And there are numbers of millionaires and billionaires that are in that situation. And one of the reasons that they are in that situation is that the tax code is shifted toward wealth. So that folks that already have money get lower rates than people who don't have money yet. It seems really crazy, but for example, investment income such as capitals gains when you sell stock, or dividends that get paid annually on stock, that gets taxed at a maximum of 15 percent a year, whereas income from work for people who earn several hundred thousand dollars – that gets taxed at 35 percent a year. And where's the sense in that? Because most of the people that have the capital gains and dividend income are the wealthiest one percent, people who are having more than a million dollars a year in income. So, that's one of the problems.

Another of the problems is that the Bush tax cuts cut tax rates for everybody but they cut them more for very wealthy people that are earning hundreds of thousands or millions of dollars a year, so under President Clinton, that highest rate for that regular kind of work income used to be 39.6 percent and now because of President Bush, it's 35 percent.

And then another tax that only affects the very wealthy that has been reduced a lot is the estate tax, and that's the tax that multi-millionaires' heirs pay when somebody passes on and their estate passes on. And that, under President Clinton, you could pass a million dollars tax free, which is quite a lot of money, but now because of George Bush and further cuts that the Republicans in Congress extracted from President Obama, now you can pass on the first $3.5 million tax free, and under this new arrangement that's temporary, $5 million per spouse, tax free, which means $10 million tax-free for a couple. Which is just a crazy amount of money for someone to be able to inherit tax free. You know, if you won that in a lottery, for sure you'd be paying quite a lot of taxes on it. But not under our current tax system. Those are just three examples of the way the tax system is rigged for the wealthiest and richest one percent. And that's why we need tax solutions for the 99 percent.

BETWEEN THE LINES: For decades, Republicans, conservatives, big corporations and the wealthy elite in the country have talked about the trickle-down philosophy that says raising taxes on the wealthiest individuals and corporations will reduce investment in new enterprises and limit or hurt the creation of new jobs. And of course, the idea that somehow higher taxes would hurt the creation of jobs is a sensitive issue in an economy that has been ripped apart by so much unemployment. But how do you respond to the idea that taxing wealthy individuals and corporations at a higher rate at this point will somehow hurt job creation?

LEE FARRIS: Well, basically, I think it's a lot of malarkey. The reason why businesses are not creating jobs is that they don't have customers with money to buy their goods. It's pretty straightforward. We at United for Fair Economy talks in part about this, it's a self-made myth about the myth about the self-made successful businessperson, and in that book, we show that in fact, any businessperson is going to be getting somewhere with the help of investments that everybody has made together through the government, whether it's the Internet, roads, bridges, whether it's an educated populace. And, the businesspeople that we profile in that book, say in so many words that their tax rate has never affected any investment decision that they've made. They're only looking at whether they're going to be able to make a profit and that the main thing that determines whether they can make a profit is whether they can get customers.

Now, with so many unemployed people, and people scared that they're going to lose their jobs, then people are less likely to buy things. Whether it's computer, or whether it's a service, people are still worried and they still don't have enough cash to buy things.

BETWEEN THE LINES: Tell our listeners a bit about your organization, United for a Fair Economy's Tax Solutions for the 99 Percent. It's a program that would rebalance our tax system to be fairer to working families and make sure that the wealthiest people in the country actually pay for some of the services that they use as individuals with lots of bucks.

LEE FARRIS: The specifics are to end the Bush tax cuts, altogether, to let them expire at the end of this year. To return to the level of the estate tax that we would've had under President Clinton, and to return to the level of the capital gains tax that we had under President Reagan. That would mean that capital gains and dividends are taxed at the same rate as income, as I was describing earlier in the show. So people can check out that on FairEconomy.org.

For more information on United for a Fair Economy, visit FairEconomy.org.

Related Links:

-

Interview with Lee Farris, conducted by Scott Harris, Counterpoint, April 16, 2012 (19:19)

Interview with Lee Farris, conducted by Scott Harris, Counterpoint, April 16, 2012 (19:19)

- FairEconomy.org/enews/take_action_on_tax_day - Tax Solutions for the 99%

- FairEconomy.org/project/state-tax-fairness - Tax Fairness Organizing Collaborative

- "Economy killers: Inequality and GOP ignorance," at Salon.com, April 15, 2012

- "Reducing Income Inequality Is the Key to Economic Growth -- Time to Pass the Buffett Rule," Huffingtonpost.com, April 10, 2012

- "Growth of Income Inequality Is Worse Under Obama than Bush," Truthout.org, April 15, 2012